Know Your Risk Tolerance Before Risking Your Assets In Market

Ms. Mithali who was managing her own portfolio had investment of 25 Lac and was mostly in equities. During the 2008 market crash, the investment started falling down and had seen the level of 12 Lac. She could not stand the losses and under the pressure of further loss in portfolio and sold off the remaining assets in loss of Rs.13 Lac and pledged not to enter the market again. She saved the fees of few thousands she would have given to her Financial Planner and in turn lost 13 Lac. There are so many investors like Mithali.

Ms. Leena also invested the amount of 25 Lac but after going through risk profiling process. Her Financial planner identified that she is moderate risk taker and suggested her to have 60:40 Equity: Debt Portfolio. Hence she had invested 15 Lac in Equity and 10 Lac in Debt. Her portfolio fell down to 19 Lac with 10 lac in Debt. She was not that stressed and her Financial Planner told her that she has sufficient liquidity in Debt and she should not look for equity valuations for next 5 yrs. He also suggested one Portfolio rebalancing by switching 1 Lac from Debt to attractive equities. Eventually she sustained the crash and her portfolio today stands at whopping 41 Lac. This is all possible only due to following the scientific process of Risk Profiling and investing only after knowing her risk tolerance.

Knowing his Risk Tolerance (RT) is the fundamental requirement of every investor. Investor generally studies the reward potential during good markets but he cannot anticipate his own behavior in case of market crashes and hence lose money. In simple words RT is his risk taking ability and any non-conformation to this will result in panic selling during the bad times of the market thereby resulting in losses. This is what precisely happens in the market at the beginning of the correction and at the peak of it. Most investors are not making any money because they are either taking more risk than they can afford (They lose money in bad times) or not taking risk due to their risk averse nature (They can’t create the wealth they deserves).

Our own ability to participate in market need not be tested during the bad times of market but can be simulated by the analysis called Risk Tolerance test. There are two terms used in Conjunction, one is Risk appetite and the other is Risk Tolerance. It is important to first understand the difference between the two.

Project risk management, System risk management, Company risk profilers and Investor risk analyst use various terminologies like Risk Capacity, Risk Threshold, Risk required and Risk appetite. However for analysis of investment risk for individual investor, so many risk Terminologies are not at all required. Only two are sufficient, Ist is Risk appetite and the other is Risk Tolerance.

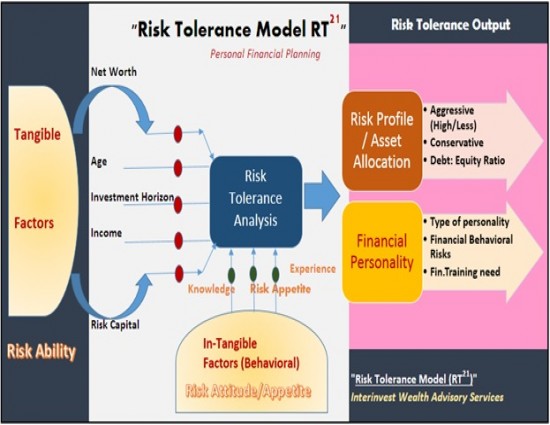

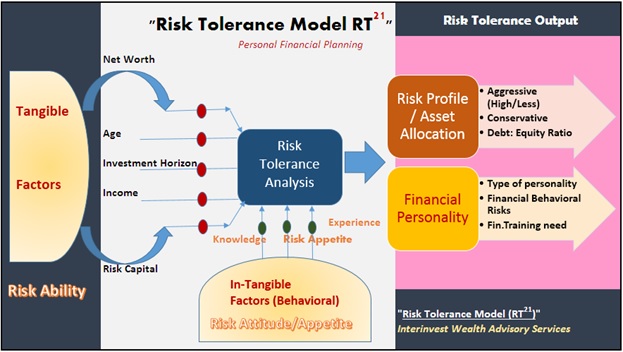

Below given model “RT21” explains as a model from Investor perspective.

Risk tolerance definition by Investopedia

Definition of 'Risk Tolerance' by Investopedia.

The degree of variability in investment returns that an individual is willing to withstand. Risk tolerance is an important component in investing. An individual should have a realistic understanding of his or her ability and willingness to stomach large swings in the value of his or her investments. Investors who take on too much risk may panic and sell at the wrong time.

Insight into the Risk Tolerance (RT)

Carefully understand every term in the definition. RT is degree of variability and hence in a sense is tangible. The definition concludes with investor’s willingness to withstand variability (risk). This “Willingness” is one’s mental dimension and is called his “Risk Appetite” or Attitude towards risk. One’s inherent Risk appetite is one thing and his perception of Equities or Financial risk appetite is other thing. His current financial risk appetite is also influenced by his knowledge and experience of the investment instrument.

Hence there are two components

- Willingness which we call Risk Appetite….. Intangible | Attitude towards Risk

- Ability to Withstand Risk …………………..……. Tangible | Ability to take risk based on Investment analysis parameters.

Understanding the model

- Risk Appetite or Attitude towards Risk

Risk tolerance of an individual requires knowing his risk taking Ability which is nothing but the Risk-Reward trade off. This being mental attitude is generally identified by a Questioner called RT Questioner. This will identify your willingness to take risk, your understanding of risk concept, knowledge and also considers experiences about equities. This will lead to identification of Risk appetite which is willingness,aperception towards risky component. This is sum total of intangible elements and hence need proper evaluation system to draw a conclusion.

- Risk Ability

There are some tangible investment factors that directly influence how much risk your portfolio should carry. These are your age, Investment horizon, risk capital, net worth & income. Although they are independent of your attitude, they are required by planner for deciding the portfolio risk.

Financial Planner will process the data then to find your Risk Tolerance. From the collected attitude data, financial personality measurement is also possible but unfortunately very few people practice this.

Generally investors are categorized as Conservative, moderate and Aggressive. Depending on the age, Investment horizon, risk capital, networth & income, the Asset allocation is arrived at which is unique to the individual investor. Once he invest in line with this allocation, both advisor and investor are sure of optimum Risk-Return possibilities.

Hence never invest your assets in market without knowing your Risk Tolerance.

Image Credits

Investor.gov