An Insight Into Financial Planning Process

Sharing my experiences of Financial Planning work. Presenting it as 10 rules that I've identified from my Learning of 12 years of advising. I'm sure it will reward you in many ways.

Financial Planning Rule 1/10

Financial Planning Rule 1/10

"Goals are the Key Drivers of Investment Decision and not the Products".

Investing without Financial Planning is like choosing to sit in a train standing on the platform where maximum people are boarding and expecting it to help you reach your destination. Pl. understand that probability of finding the correct road is very less if you are not clear about the Goal. Chief Problem is that Investors Choose Product First and expect it to lead to their goal. Who should be blamed for the debacle at the end? Definitely no one, it is the Wrong approach!

Ideally it should be Goal Analysis and then the Product analysis. Your Financial Goals will decide the Products suited for you.

The inconvenient fact is that many people do not know why they are investing.

Financial Planning Rule 2/10

"Goal Prioritization & Goal Value assessment is the first step of 1000 Miles of Financial Journey."

"Goal Prioritization is very important to ensure that short term low priority goals don’t eat away the wealth reserved for high Priority Long term goals". Value of each goal must be identified as present and future value.

Goal prioritization needs more of an attitude than the intelligence. List down your goals in the order of priority and be ready to postpone the short term goals. If you are given a choice by your planner that you either postpone your plan for purchase of car by 3 years or else you need to postpone retirement by 2 yrs, what will you prefer?

Some goals like child education & marriage can’t be postponed anyway!

Every house Hold Balance Sheet should be managed like Company Balance Sheet. The investment decision should be based on the future needs of money. It has been commonly observed that the investors have no quantitative idea of goals.

Financial Planning Rule 3/10

"Understand Your Risk Tolerance (RT) before risking your assets in Market ".

Risk Tolerance is the degree of variability in investment returns that an individual is willing to withstand. Risk tolerance is an important component in investing. Risk Tolerance is not the function of age but is your attitude towards possible risk to portfolio.

An individual should have a realistic understanding of his or her ability and willingness to stand large swings in the value of his or her investments. Investment decision should be based on the allocation he needs as per his Risk Tolerance & other factors discussed later. Investors who take on too much risk may panic and sell at the wrong time.

Financial Planning Rule 4/10

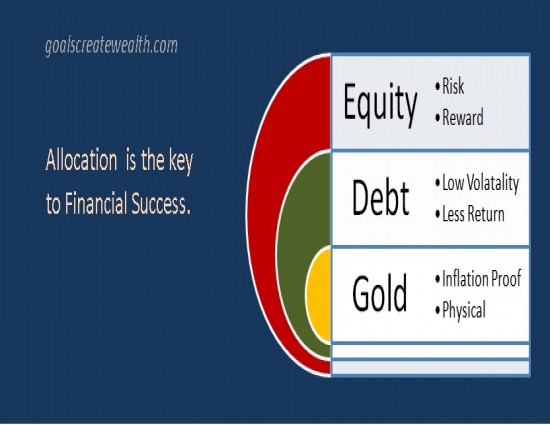

"Asset allocation is the key to Balance your Risk-Reward ratio”.

Asset allocation is about the decision of distributing the money in various asset classes like Commodity, Equity, Fixed Income and Real assets. Asset allocation is distribution of risk that exists in various asset classes.

If somebody invests money only in equities, he may lose quiescence during the bad days of market and sell all his holdings to book loss. However if he has distributed a part in Gold, he may be happy to see the appreciation in gold which in common in financial uncertainties. Hence overall portfolio will have less volatility and better liquidity as well.

1) Allocation is putting eggs in more than one basket.

2) Knowing how many eggs to be put in available baskets!

Financial Planning Rule 5/10

"Asset allocation for the individual is a function of one’s Risk Tolerance (Attitude towards downside), Age (Life stage) & Liquidity needs (Investment Horizon)".

Asset allocation required by an individual is the function of above three factors. If one has a good risk appetite but has some important liabilities to be executed, it will not make much sense in keeping equity oriented portfolio even if he/she has good Risk Tolerance.

With increasing age the goals approach closer and it becomes important with ensuing goal that the volatility in portfolio should be in control. Hence for higher age, higher fixed income portion in a portfolio is recommended.

Financial Planning Rule 6/10

“Discipline & Patience Pays. Eventually, the portfolio with Correct Asset Allocation (AA) will beat the portfolio of the best funds & no consideration of allocation”.

Investor may find during the bull run that the aggressive portfolio is scoring over the lesser aggressive portfolio. This forces him to increase the equity ratio. Few may go a step ahead and invest by taking loan. However when the markets take downturn, the investor may turn wary and sell off the stocks in loss. Panic feeling will wash out all profits and force you to book losses. This happens with many investors who have no consideration of AA.

On the other hand the person who follows the discipline of AA has lesser concern for portfolio fall because of the presence of non-risky asset classes and hence continues to HOLD ON during bad times.

Financial Planning Rule 7/10

"Financial Planning is incomplete without appropriate Risk Management".

Choice of Proper insurance cover relevant to you is very important. Wealth creation is about the upside in portfolio & Insurance is covering the downside in the event of unfortunate death or critical health problem. Appropriate amount of Hospitalization cover should be taken to prevent sudden requirements of funds leading to erosion of portfolio as a result of unexpected health problems.

Financial Planning Rules 8/10

"Portfolio re-balancing is the tool to continuously achieve desired Asset allocation".

[AA]r = Asset allocation required as calculated from your RT (Risk Tolerence).

[AA]a = Actual Asset allocation at a particular time.

[AA]r is the calculated value of Asset allocation as worked out by the Financial Planner and a client at the time of Fin. Planning. Portfolio’s actual asset allocation [AA]a however will change daily depending on the swings in market. The same needs to be re-balanced after a particular interval or significant change in [AA]a.

There is no ideal horizon to re-balance. You can re-balance it after say 5% or 10% drift in allocation. However the Tax and exit loads needs to be considered.

Financial Planning Rules 9/10

"For your short term and medium term goals use Debt part of Portfolio. Long term goals should be primarily accomplished using Equity asset class".

This is important rule of Financial Planning Process. If you have some liabilities or short term goals which you need to address in 1-5 yrs period, equity asset class is not the proper asset class for this. This is because of the market dependence.

If you are planning for long term wealth creation, it’s risky to invest everything in Low yielding assets like debt funds in the name of safety. It's because Wealth created gives you actual goal security and not the apprehension of losing money. If there is some asset class that has beaten the inflation over the years, it’s equity only.

Financial Planning Rules 10/10

"You should have corpus sufficient enough on the day of retirement to support you up to the age you expect to live".

People are ignorant about a biggest risk called inflation. It’s continuously eating away your capital. Your investments should be such that after fulfilling all life goals, you should have corpus sufficient enough on the day of retirement to support you up to the age you expect to live.

After fulfilling all your liabilities, on retirement day you should be ready with the Kitty sufficient enough to cater you till the age of say 85-90, whatever ever you expect to live. These calculations are complex and better to get it done from a professional financial planner.